Renters Insurance in and around Plano

Looking for renters insurance in Plano?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Calling All Plano Renters!

Think about all the stuff you own, from your stereo to bookshelf to silverware to guitar. It adds up! These valuables could need protection too. For renters insurance with State Farm, you've come to the right place.

Looking for renters insurance in Plano?

Renters insurance can help protect your belongings

Safeguard Your Personal Assets

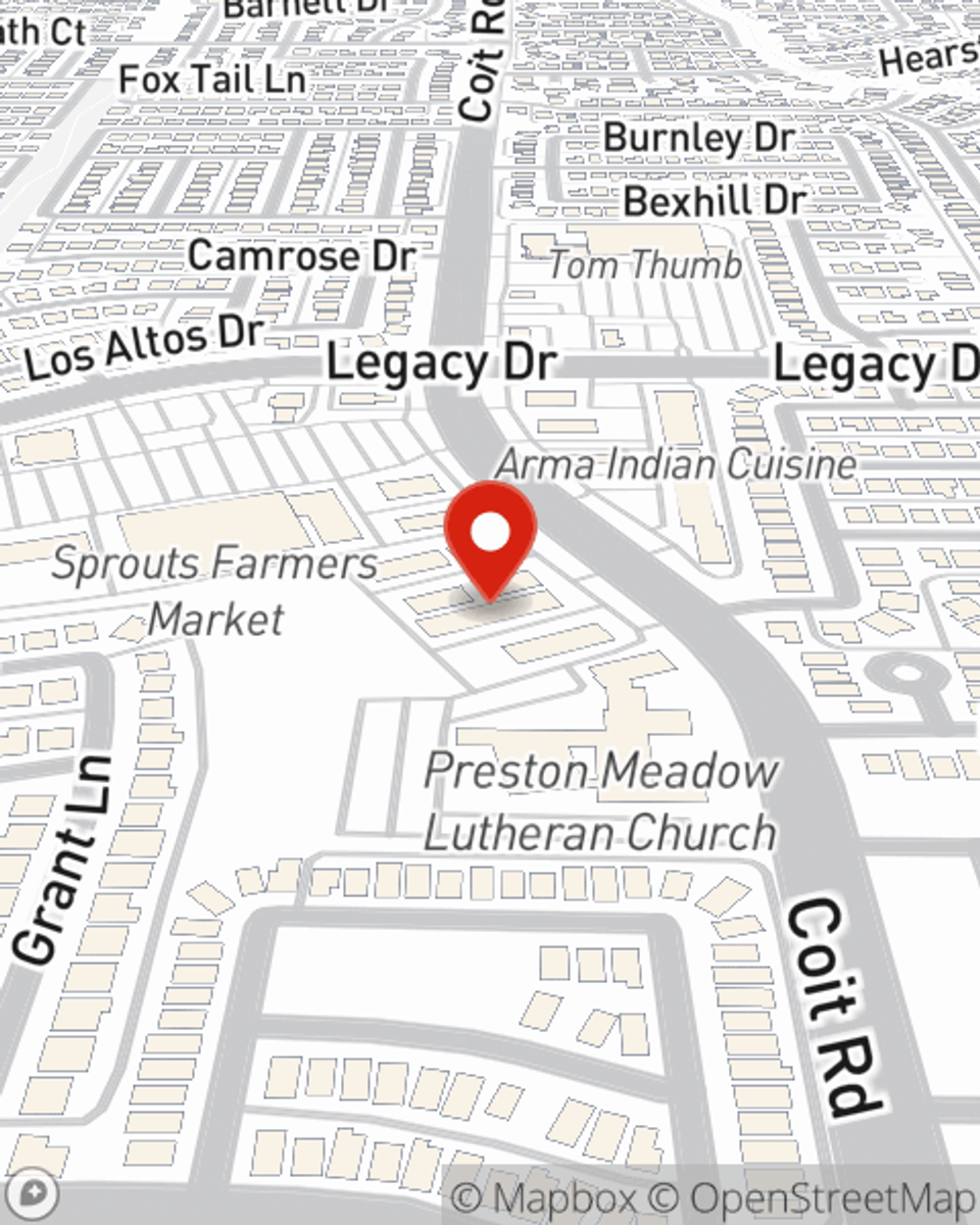

When renting makes the most sense for you, State Farm can help shield what you do own. State Farm agent Todd Redding can help you create a policy for when the unpredictable, like a water leak or an accident, affects your personal belongings.

There's no better time than the present! Contact Todd Redding's office today to discover the benefits of a State Farm renters policy.

Have More Questions About Renters Insurance?

Call Todd at (972) 238-7896 or visit our FAQ page.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Todd Redding

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.